Is There a Recession Coming and How Will It Affect the Housing Market?

Hi Everyone!

I realize that this week's blog was supposed to be about small businesses in the area, but I felt that it was necessary to write this blog instead. I will return to my Experience Ann Arbor series next week.

There are all kinds of headlines in the news right now about the impending recession. Realtor.com did a survey of people who are considering buying/selling in the near future. They found that 53% of people think a recession will happen in the next 15 months and because everyone is still suffering from PTSD from the last recession, 57% of people surveyed believe that the next recession will be as bad or worse than the 2008 recession. This is probably why 55% say that if a recession does occur they will hold off on buying a house. That may sound like a good idea at first when you think back to the housing crisis that caused the 2008 recession, but it is actually a big mistake that could end up costing you a lot of money! So if you have been considering buying or selling, don't let the headlines scare you. Real estate is probably the best way to invest your money over the next year or so!

Now that I've told you what the general perception of the next recession is, and how buying and selling may be a great move financially, I'm going to tell you what the facts are behind it.

Fact #1: We are in the longest recovery in American history.

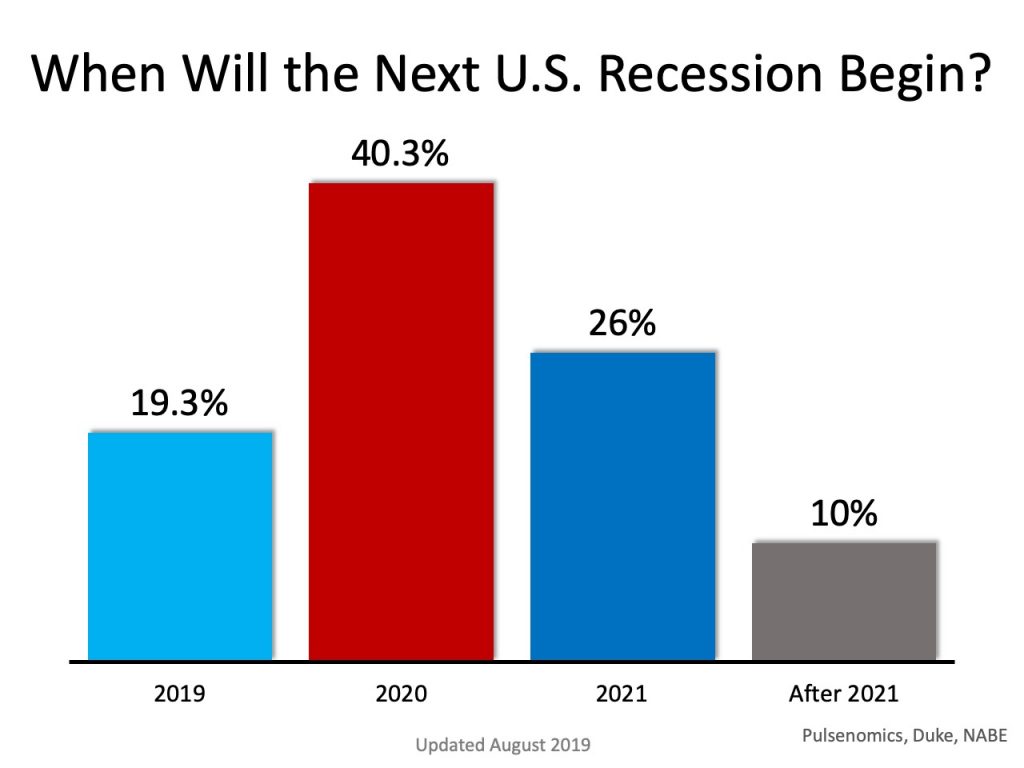

We have been in an economic recovery for the last 123 months (more than 10 years). We actually hit the record on July 1st of this year beating out the old record of 120 months. That being said, yes, we will at some point go into a recession. Throughout American history, the economy has gone through cycles of recession and recovery. That's just the way it goes. So when will the recession begin. No one knows exactly, but it is estimated that it will begin sometime next year.Fact #2: What ends a recovery is an economic slowdown.

An economic slowdown is defined as 2 consecutive quarters where the GDP (Gross Domestic Product) slid (aka a recession). It is not the same thing as a housing crisis. Though we don't know when a recession will begin, this slowdown/recession will most likely continue until election day. This is because it will be in the news so much due to the candidate debate over the economy. Once the election and debates are over, things should settle down again.Fact #3: The main trigger for the next recession will not be housing.

There were two main triggers predicted for the 2008 recession1. Housing crisis

2. A Melting Mortgage Market.

As we all know, that is exactly what happened! The same people who predicted those triggers have made a prediction for our next recession. For the upcoming recession, they predicted that the top 3 triggers would be

1. A Trade War

2. The Stock Market

3. A Geo-Political Event

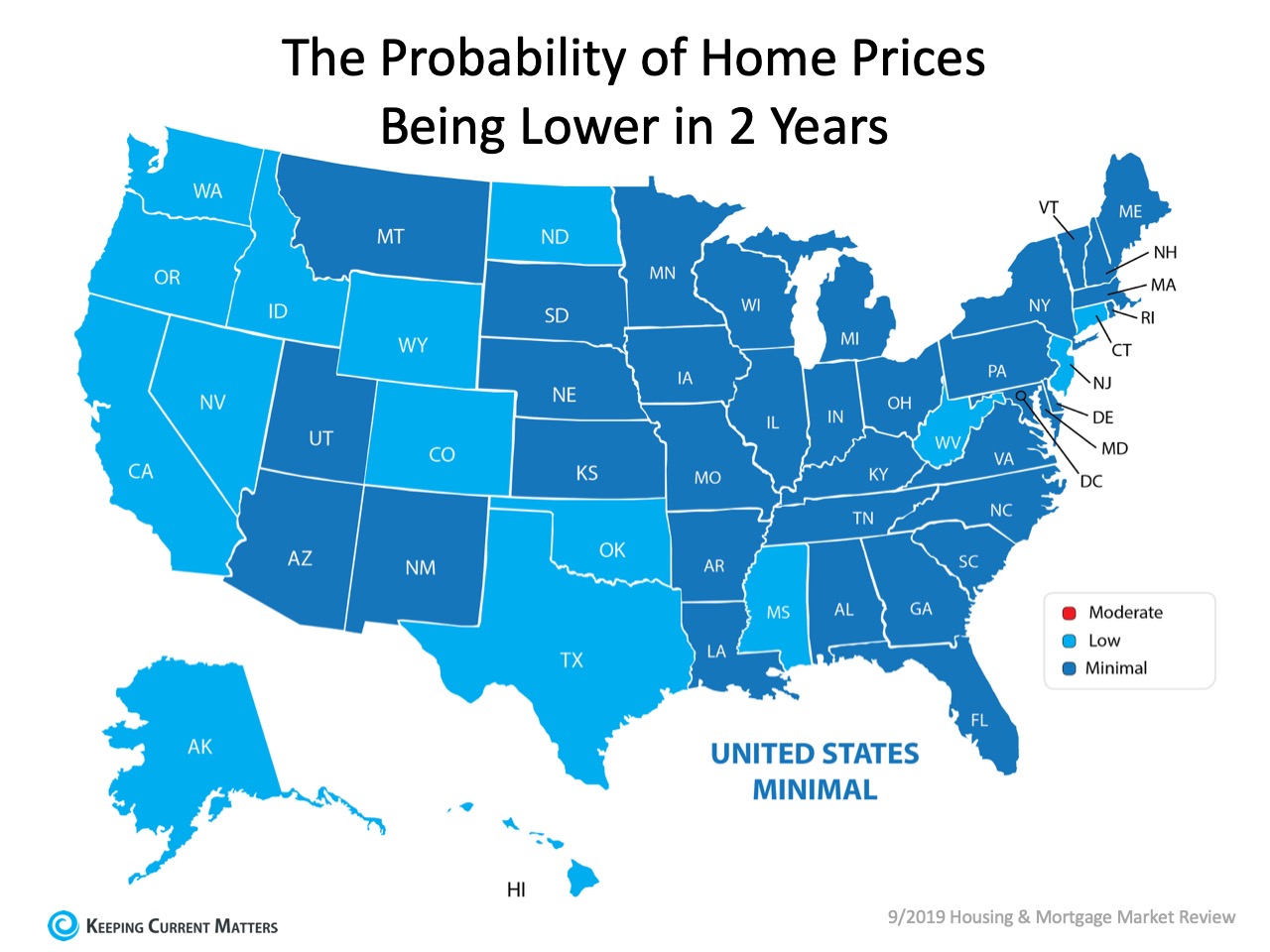

Housing isn't even in the top 5. It's all the way down at #9. Even at #9, it isn't predicted to be a housing crisis, but rather just a housing slowdown. And even then, home prices are expected to rise.

Fact #4: Historically speaking, when the stock market gets crazy, people tend to pull out of the stock market and buy real estate.

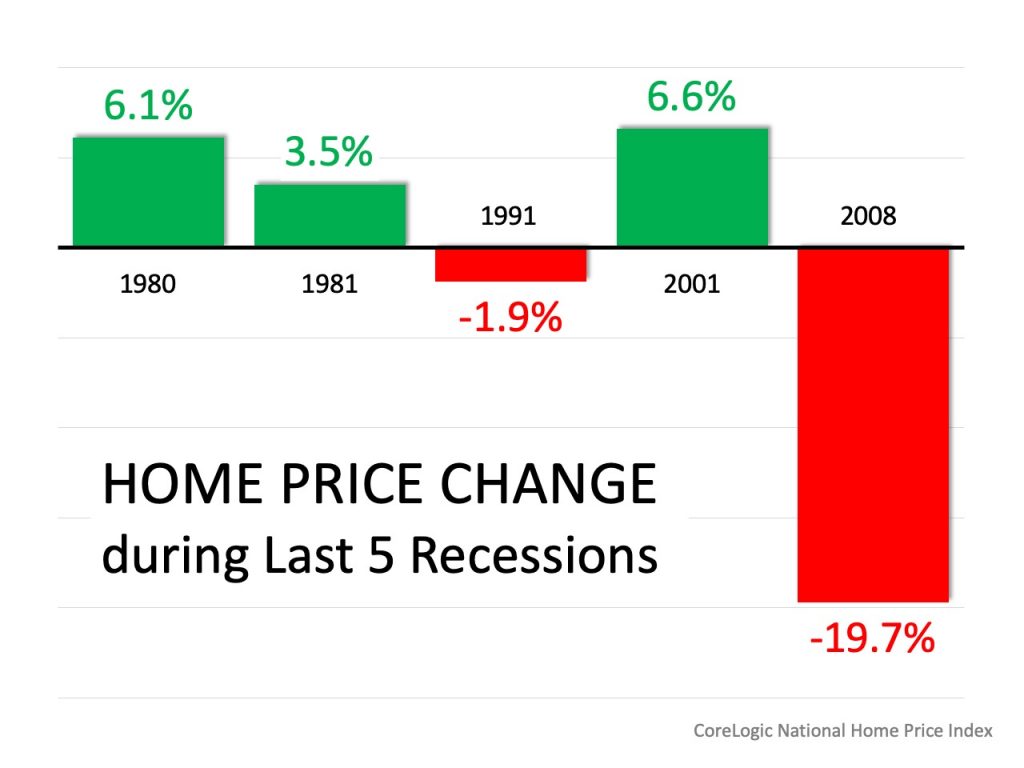

Why? Because real estate is a stable long term investment. Over the last 5 recessions, home prices have risen during 3 of them. During the 1991 home prices declined, but by less than 2%. The reason that the 2008 recession hit the housing market so hard was that it was actually caused by the housing market. In the same way, the 2001 recession hit the stock market hard because it was caused by the stock market.

What does the recession mean for the housing market?

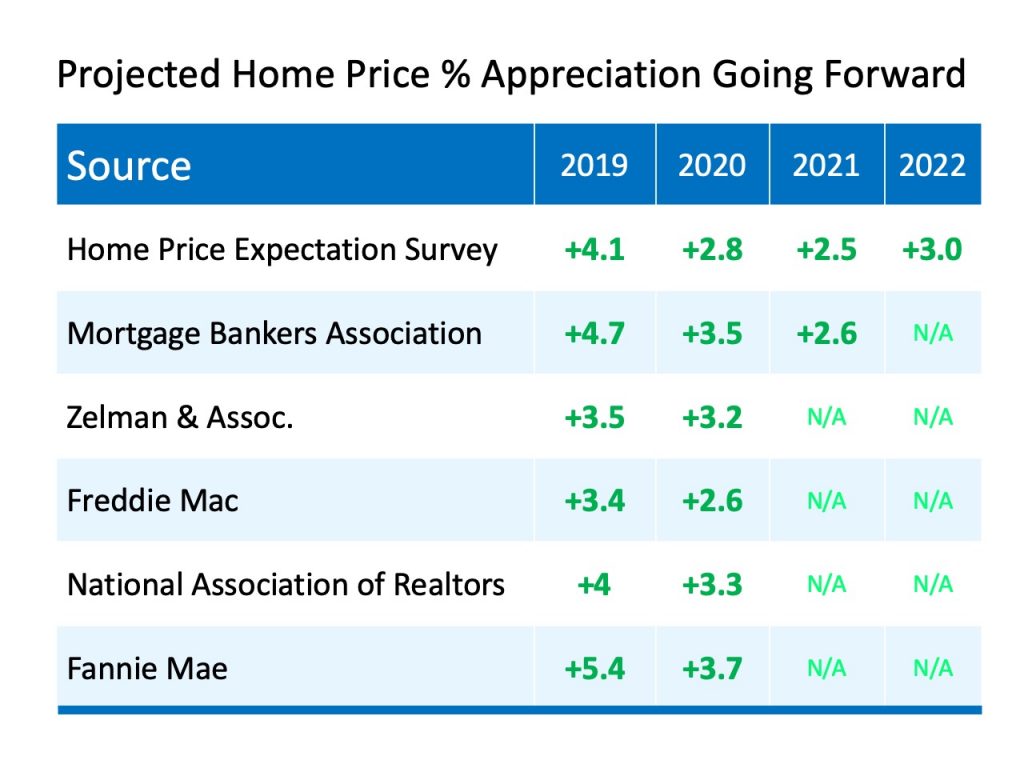

Will there be a recession? Of course! The economy can't stay in recovery mode forever. All good things come to an end. Will it cripple the housing market? Absolutely not! There is a HUGE difference between a recession and a housing crisis. So what will the recession be like? Well, it will most likely look like the 2001 recession where the stock market fell almost 25% and yet housing went up 6.6% (which is almost double historic norms). In fact, it is predicted that home prices will continue to rise for the next 2-5 years!

So, even if you haven't been considering buying or selling, you may want to consider it now. Mortgage rates are still low and the way it's looking, real estate is probably a much better way to invest your money than the stock market over the next year or so!

I hope this helps clear some things up for you! If you have any questions, please don't hesitate to contact me!

Have a great day!

Chrissy Myers, Realtor

Real Estate One

937-241-7123

ChrissyMyers.com

ChrissyMyersREO@gmail.com

1365 E Michigan Ave

Saline, MI 48176

Comments

Post a Comment